What is a good credit score?

Hey there, folks! Today, we’re diving deep into the world of credit scores. You might be wondering, “What is a good credit score? Why does my credit score matter?” Well, let me tell you, having a good credit score can make all the difference in your financial well-being. Whether you’re looking to buy a car, rent an apartment, get a credit card, or even land that dream job, your credit score plays a huge role.

So grab your favorite morning beverage, get cozy, and let’s really break this down

The Basics: Understanding Credit Scores

Before we jump into what makes a good credit score, let’s quickly go over what a credit score is.

Think of your credit score like your financial report card – it’s a numerical representation of how responsible you are when it comes to borrowing and repaying money. This three-digit number gives lenders a quick snapshot of how risky it is to lend money to you.

The higher your score, the more likely you’ll get approved for loans and credit cards with favorable interest rates. On the flip side, lower scores translate to higher interest rates or even rejected applications.

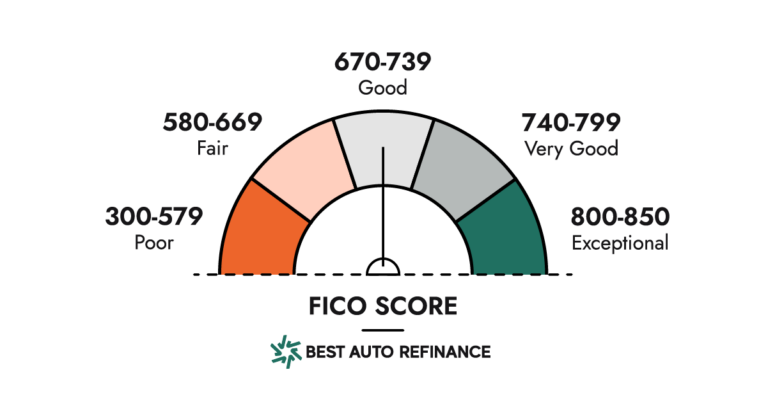

Credit scores range from 300 to 850, with the average American falling around 690 to 719. Anything over 720 is generally considered excellent credit, while scores lower than 580 are seen as poor or bad credit.

Fico Score

There are a few different credit scoring models used by lenders, but the most common one is your FICO score. This model was created by the Fair Isaac Corporation and makes up 90% of credit scores used by lenders.

Your FICO score is calculated based on these five main factors:

- Payment history (35% impact) – Whether you pay your bills on time, including credit cards, loans, utilities, etc. The best way to build credit is by establishing a long history of on-time payments.

- Credit utilization (30% impact) – The ratio between your total available credit and how much you currently owe. Keeping credit card balances low compared to your limits helps this important factor.

- Length of credit history (15% impact) – The average age of your accounts and how long you’ve been using credit responsibly. Older accounts help raise your score.

- New credit (10% impact) – How often you apply for and open new credit accounts. Too many new accounts in a short timeframe can lower your score.

- Credit mix (10% impact) – The variety of credit types you have, such as credit cards, installment loans, mortgages, etc. A healthy mix helps your score.

In addition to your FICO score, you also have VantageScore credit scores from the three major credit bureaus (Equifax, Experian, TransUnion). These scores use slightly different formulas but still range from 300 to 850.

Checking all of your credit scores from each bureau gives you a complete snapshot of your current standing across lenders. You can access these for free once a year at annualcreditreport.com.

Now that we understand what goes into a credit score, let’s explore what range is considered “good” and why it matters…

The Credit Score Ranges

Okay, let’s get into the meat and potatoes – what target range should you aim for with your credit score?

While different scoring models may have minor variations, here is a general breakdown of the credit tiers and what is a good credit score:

- Excellent – 800 and above – If your score is in this top tier, give yourself a pat on the back! You’ll have no trouble getting approved for credit cards and loans with the best terms like low interest rates.

- Very Good – 740 to 799 – This is a solid credit score range. Lenders will view you as a reliable borrower and offer competitive rates.

- Good – 670 to 739 – Don’t fret if your score falls in this range. It’s still considered good credit. You may face slightly higher interest rates but can still qualify for most loans.

- Fair – 580 to 669 – Scores in the fair range are below average. Lenders view these applicants as potentially “risky”. You may face more scrutiny or restrictions when applying for financing.

- Poor – 579 and below – Uh oh! If your credit score is this low, it’s time for damage control. You’ll likely have difficulty getting approved for loans and credit cards at reasonable rates.

Ideally, you want your credit score to be good to excellent. This gives you the most options, flexibility, and affordable repayment terms when borrowing money. Even a small score increase in these ranges can save you thousands on interest charges over time.

On the other hand, having poor credit under 580 will make getting a mortgage, car loan, car refinance, home refinance, or apartment rental much more challenging and expensive.

Now that we know the score ranges let’s explore why having a good credit score matters so much in real life…

The Impact of a Good Credit Score

A solid credit score in the good to excellent range opens doors for you financially. Here are some of the biggest benefits of maintaining responsible credit habits over the years:

1. Lower Interest Rates

The top reason you want excellent credit is simple – lower interest rates save you serious cash.

When you have a proven track record of on-time payments and responsible borrowing, lenders view you as lower risk and reward you with lower interest on loans and credit cards. This saves you hundreds or even thousands of dollars over the lifetime of a mortgage, auto loan, or other financing.

For example, the difference between a 5% and a 3% interest rate on a $300,000 mortgage results in $42,000 in interest savings! The higher your credit score, the more opportunities you have to lock in these big interest rate discounts with lenders.

2. More Financing Options

Beyond lower rates, a higher credit score also means you can be more selective with lenders and credit products. You can shop around and choose the best loans, cards, and terms for your needs.

With excellent credit, hundreds of lenders will be vying for your business! This gives you leverage to negotiate the ideal repayment timeline, credit limit, fees, and other conditions when borrowing money.

Poor credit limits your options to just subprime lenders willing to take on riskier borrowers – but they charge astronomical rates in return.

3. Approval for Competitive Credit Cards

In addition to loans, raising your credit score also means access to the top credit card offerings.

Cards like the Chase Sapphire Preferred and American Express Platinum don’t even consider applicants with scores below the mid 700s. Excellent credit unlocks these premium cards with lucrative sign-up bonuses, points programs, and perks.

Responsible card management is also key for meeting daily spending needs while avoiding interest charges. You have more freedom to earn rewards when issuers trust you with higher credit limits.

4. Smoother Rental and Employment Background Checks

Even beyond borrowing, your credit score can impact other areas of life. Many landlords and property managers screen prospective tenants with credit checks and minimum score requirements.

Certain employers – especially government, banking, or financial positions – may also check your credit as part of the hiring process.

Excellent credit scores show financial maturity and responsibility to landlords and hiring managers alike.

5. Purchasing Power for Major Milestones

Finally, achieving major financial goals like buying a house, starting a business, or paying for college is infinitely easier when you have a solid credit history behind you.

Poor credit adds unnecessary obstacles and expenses to big life purchases. Excellent scores mean you can focus on achieving your dreams, not just managing payments.

The Downside: Poor Credit Scores

Now that we covered the many doors excellent credit can open let’s look at how low scores can shut them in your face. Here are some of the common downsides of having poor credit:

- Sky high interest rates that cost you thousands extra in interest, making purchases more expensive

- Very few loan or credit card options, forcing you to accept unfavorable terms from subprime lenders

- Constant deposit requirements and restrictions from landlords leasing apartments or houses

- Potential employment roadblocks if companies require credit checks for your position

- Difficulty financing vehicles even when you need them to earn an income and get to work

- Rejection when applying for affordable mortgage rates, forcing you to delay homeownership

As you can see, bad credit traps you in an expensive cycle that is tough to break out of. Luckily, we have tips for raising your credit score.

Chart a Path to Financial Freedom

An excellent credit score can be your ticket to financial freedom. Responsible borrowing, smart credit management, and optimizing your score early on all set you up for success.

But it’s never too late to take control of your credit and turn it around – a “fresh start” takes time but pays dividends. Even a 100 point increase can open new doors for loans and interest savings.

With the strategies and motivation above, you now have the knowledge to build your dream credit score. So grab your credit reports, make a game plan, and watch your borrowing power increase!

Stay tuned for more tips on optimizing every area of your financial life. Your awesome new credit score will be just the beginning. Until next time, friends!